Predominant Use Study

Predominant Use Study

Predominant use studies, also known as utility studies, save companies many thousands of dollars annually by analyzing their expenses for electricity, water, natural gas and propane, and by identifying the expenses that qualify for tax reductions or exemptions under state, county and city laws. In order to encourage business development, 21 states* offer significant utility sales tax reductions and most of those states require that the majority of energy consumed be utilized to facilitate the company’s predominant purpose. A predominant use study prepared by an expert is often required by government authorities to assure compliance with all legal qualifications for utility tax reductions or exemptions.

The qualifications for valuable utility tax reductions vary from state to state. Types of businesses that benefit most from having a predominant use study performed include:

• Almost all types of manufacturing facilities

• Agricultural and horticultural companies

• Food and beverage processers if less than 50% of their product is consumed the same day it is produced

• Bakeries and other food producers that utilize gas operated ovens

• Companies that extract sand, gravel, minerals, oil or gas from the ground

• Golf courses

• Nursing homes, retirement homes and assisted living centers

• Educational, charitable and religious facilities

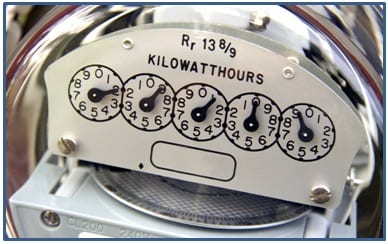

The predominant use study report for a facility lists the kilowatt/hour electrical consumption at each electric meter, the cubic foot consumption of gas at each natural gas meter and the volume of water transmitted at each water meter. The report also evaluates the electricity, gas and water usage from every relevant piece of equipment in the facility. Each piece of equipment that consumes energy or natural resources is separated into either processing or non-processing categories in accordance with the State Comptroller’s regulations. Correct understanding of exactly where and how major energy use occurs is always the first step toward indentifying the areas where significant cost savings can be generated.

State and local laws are frequently revised. For example in Texas, new regulations stipulate that predominant use studies produced prior to April of 2005 are obsolete. Most companies can benefit from having a current predominant use study. Companies can also benefit from having a new predominant use study prepared if an existing facility has been relocated to a new site or expanded, if there has been a change of ownership, or if utility providers have changed. Most large companies can save between 6% and 8.25% on their monthly utility bills by having a current predominant use study report, and most states will allow tax incentives retroactively.

* Note: The 21 states that offer significant utility sales tax reductions are Arkansas, Colorado, Florida, Indiana, Iowa, Kentucky, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Vermont, Virginia, Wisconsin and Wyoming.

SMART TAX USA

Smart Tax USA Florida

CONTACT US TODAY!

SMART TAX USA specialized comprehensive analysis can determine how these new exemptions; credits and incentives directly affect your business. This will result in a reduction of current and future tax liabilities providing significant tax savings for your business! Most importantly our success rate is 90% of the companies we work with will have a substantial tax saving benefit. Our initial review will determine the validity of your refund status and as always, the consultation is absolutely free. Our work is performed on a contingency fee basis, “if we do not perform no fee is due!”